Forexearlywarning has a high confidence gold trading system that uses gold correlated pairs and our real time heatmap system. The chart setup also had gold correlated pairs for increased confidence on your trade entries. This gold trading system can also be applied to other gold trading instruments like gold cryptocurrencies and Gold ETFs.

Basic Principle To Increase Trading Confidence

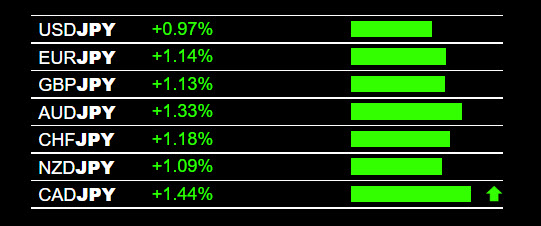

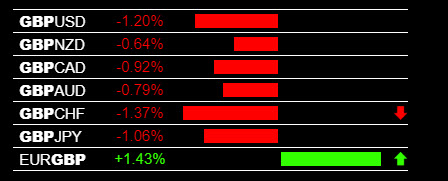

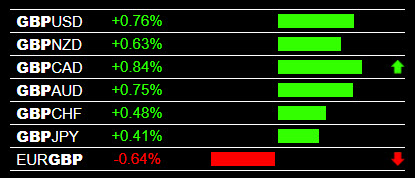

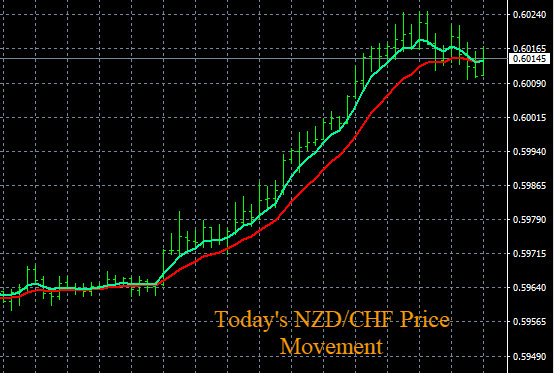

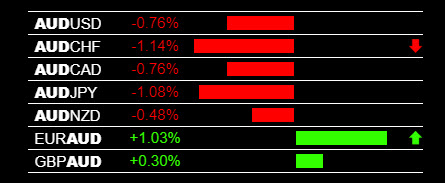

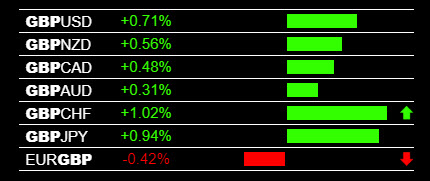

Most gold traders trade the XAU/USD pair due to the wide availability and low spread. This makes sense. But almost always gold traders ignore the cross-currency strength or weakness to get to the best possible trade. Look at the example below Most XAU pairs dropped consistently but some moved slightly faster and easier because the cross currencies have some strength.

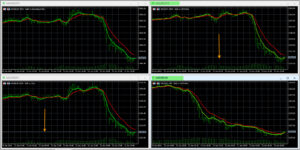

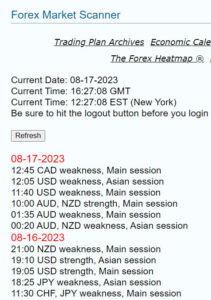

The top tool you see is The Forex Heatmap® with gold pairs isolated. It works for 28 forex pairs plus all correlated pairs against the major currencies, plus gold. Right click on the charts above and open in a new window to see two XAU/USD time frames plus two more correlated pairs. You can add two more correlated pairs to have 6 charts on one screen for high confidence gold trading.

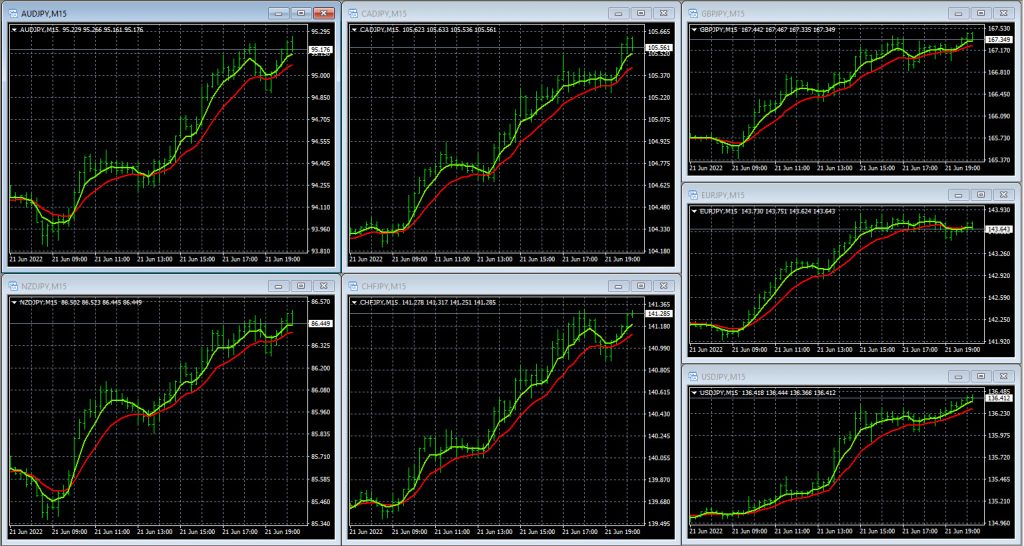

Gold Trading System Chart Setup With Correlated Pairs

With the live gold signals above you can see most gold pairs had somewhat even movements. This is because gold was weak but most of the cross currencies were neutral in this trading particular session. Selling XAU/USD is probably okay in this situation. But sometimes if XAU is weak the USD will also be weak and it obliterates the trade. Always trade strong versus weak using these live gold trading signals. Selling XAU against USD, NZD or GBP was probably okay with this signal on this trading day. Check your platform for these pairs and check to see if the spreads are acceptable. This live tool for trading Gold is called The Forex Heatmap® and is also accurate for trading 8 currencies and 28 forex pairs.

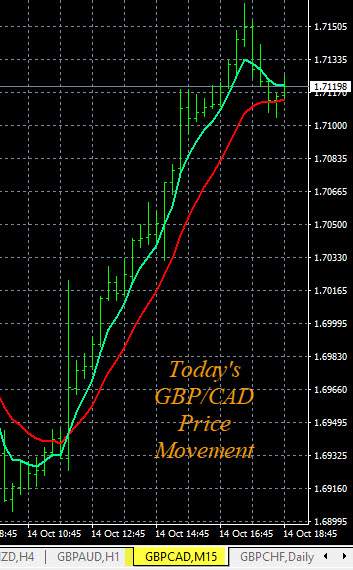

For your gold trade entries, set up your charts with several correlated gold pairs to match the heatmap configurations. For trade entry verification, gold traders can use our Gold Heatmap live indicator with correlated pairs. The chart you see above are our free trend indicators set up on multiple correlated pairs and two time frames on XAU/USD, top notch professional setup with our live gold heatmap indicator. You can set up as many as 8 gold pairs on one screen or use more than one time frame on the same pair.

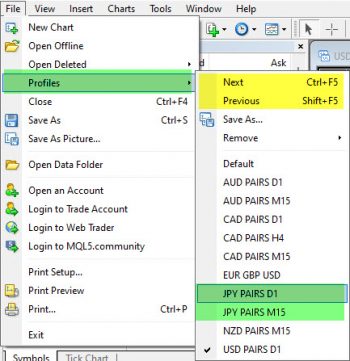

You can set up your charts using the metatrader profiles with correlated pairs on Metatrader or any equivalent charting system. Some brokers outside USA offer a direct copy of our multi-chart system for all gold pairs and this is an impressive charting system for spotting strong gold movements and high confidence trading.

Gold Brokers

Many forex traders outside the USA offer gold trading. You can get many broker choices with leverage as high as 500:1. Inside the USA CFTC regulations are restrictive on gold trading. Most prop firms are located outside of the USA so Gold is available for trading, even for USA clients, in a funded forex account. Gold is the most popular asset traded by prop firm traders and XAU/USD has high liquidity, volatility and low spreads.

Gold Pairs And Other Instruments That Can Be Traded

XAU/USD or any other combination of XAU against a major currency, assuming the spread is low, can be traded with this heatmap and chart system. XAU/USD is the most widely traded and the spread is very low. Trading Gold via crypto tokens is also an option via Pax Gold and XAUT Tether Gold, with up to 10x leverage. XAUT plus a total of 10 other tokens opens up possibility of gold perpetual futures trading on margin also. On equities trading platforms, SPDR Gold Trust ticker symbol GLD NYSEARCA: GLD trades like a stock on the NYSE. Ticker symbol GLD has high liquidity and can be traded as a stock or with vanilla put and call options. So GLD is optionable and buying or selling vanilla puts and calls like selling covered calls is also possible.

Example Trade Scenarios for Gold

Best times to trade gold are when significant price breakouts occur or after impotant news drivers from the USD, JPY or EUR, which are the top 3 most traded currencies. If Gold is strong best scenario is to trade against weak cross currency for best movement. If Gold is weak best scenario is for trade gold against strong cross currency.

Gold pairs are two instruments XAU/XXX so all of the principles of strength against weakness and parallel and inverse analysis apply to gold pairs, same as any currency pair in our system. Our principles for our entire trading system for 28 currency pairs also applies to gold trading. Trend, momentum and price target will always net you winning trades. Sometimes the USD strength or weakness alone will drive some movement and golx XAU itself is actually neutral. Our heatmap tool will show you these types of signals in real time.

Alert Systems For Gold

Gold traders can set price alerts at price breakout points to notify them when the price might be moving. These are desktop audible price alerts. Gold traders can also set straddle alerts, which is two breakout alerts at support AND resistance breakout points to monitor gold movements in two directions. When the price alert hits check our Gold heatmap for trade entry verification. In many instances gold starts moving after USD news drivers, so the news calendar is also a valuable tool for knowing when to monitor gold.

Set a trading plan for gold by looking at the higher time frames for overall direction, then set audible price alerts on significant breakout points with lots of upside on the H1 time frame or higher. When the alert hits check the gold heatmap and smaller time frames like the M5 and M15 for your entry time frames. Our push alert system also sends Telegram push alerts when the USD is strong or weak so any USD push alerts you get should be checked for XAU/USD signals. If gold is going sideways and not trending, traders can maintain two price alerts on XAU/USD and breakout points in both directions, this is called a straddle alert.

Forexearlywarning also has a push alert system for 8 currencies on Telegram. If you get a push alert that the USD is weak you can check XAU/USD for a buy trade entry. Works the same way in two directions for all 8 Gold pairs.

Our Views of Gold As A Trading Instrument

Since we launched the gold heatmap we have seen many impressive movements. Gold is volatile, it is widely traded, high liquidity, popular among the entire trading community and can give traders 1 or 2 strong movement cycles per week. We feel like it is a strong addition to the Forexearlywarning trading system and will add to pip totals. We believe our clients agree with this view and gold will be a welcome addition to our trading system.