This article will present a rules-based forex trading system and a short list of rules for more accurate trade entries. We will also present another list of rules for managing the trade after entry, using our published trade management procedures.

By incorporating these rules into your forex trading, trade entry accuracy and pip totals should increase substantially. We will start with some basic rules for a simple but effective forex trading system. Then you can increase the number of forex trading rules to limit the number of trades, or to enhance the results and overall pips captured on a trade-by-trade by trade basis.

Why Trade The Forex With Rules?

Setting up a rules-based forex trading system allows you to formulate a complete trading system based on those rules. It also gives you the ability to test any trading system or method. This is much different than random trade entries. Rules must be specific, not general. With rules you know when to buy or sell, this reduces stress and is a great tip for beginner forex traders to proceed into demo trading then live trading.

A rules-based trading system means you do not guess or use discretion from trade to trade. You simply follow the rules. The rules you set up should be simple. All traders should avoid complex rules, systems, and standard technical indicators that cannot be easily explained.

If you set up a rules-based forex trading system for entering trades and you rigidly follow these rules, the results should be positive trades, pips, and profits. If the results are consistent losses with few or no winners, then the rules you set up or the trading system you are following is a faulty system. Abandon the system and set up new rules based on a new set of rules that is specific to that system. Fortunately, you can discover a faulty system with demo trading, without any financial risk or actual monetary losses.

If you start to enter demo forex trades based on your trading rules and you simply cannot make any profitable trades, your system is likely faulty or ineffective. The culprit is more than likely the technical indicators behind the system, because technical indicators proliferate the forex industry and simply do not work.

Here Are Some Trading Rules To Get Started

Here is an example of a basic set of five entry rules for any trade for use with the Forexearlywarning trading system.

Rule 1 – Trade in the direction of the primary trend on the higher time frames, H4 and larger.

Rule 2 – Only enter trades with no nearby resistance on buys or no nearby support on sells, at least 100-125 pips, and at least 200 pips on some highly volatile pairs.

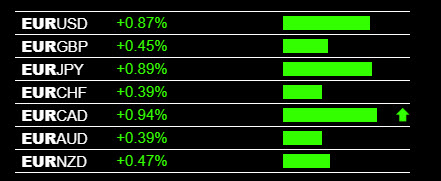

Rule 3 – Trade only if one currency is consistently strong or the other one is consistently weak, or both. See an example of consistent Euro (EUR) currency strength below using our real time trading tool called The Forex Heatmap®.

Rules Based Forex Trading Trade Entry

If the EUR/CAD or EUR/JPY is trending up on at least the H4 time frame, go ahead and buy the pair. You can see the movement was very strong, 125 pips in one trading session on just one pair. Not a bad start.

Rule 4 – Trade only in the main forex trading session for at least 6 months.

Rule 5 – Demo trade first, then move to micro lot trading with stop orders, then continue to scale up to mini lots over time. Build your experience base.

Using these five simple rules we lay out in here should result in significant positive pips for any forex trader, without relying on any technical indicators whatsoever. This way you can make sure your system is valid and effective before committing any real money and going to live trading. Use these rules for trading 28 different pairs with high liquidity. The momentum signals are provided by The Forex Heatmap®.

Rules For Trade Management

We will now present 3 basic rules for managing the trades. Any good rules-based forex trading system will also have rules for trade management and money management. Here they are:

Money Management Rule 1 – Always trade with a stop order.

Money Management Rule 2 – When your trade entry goes into positive pips, like +30-50 pips or more, scale out half of your lots and move the stop to break even. This is a basic rule of thumb for profit management.

Money Management Rule 3 – Do not enter a trade unless you can possibly get at least 3 pips for each pip you risk. This is a +3 to 1 money management ratio, minimum. For example, if you start your trade with a 30 pip stop you must be trying to get at least 100 pips from that trade potential reward. This is predetermined risk versus reward ratio, in this case +3.3 to 1 which is 100 divided by 30.

Trading Rules For Other Situations

Each paragraph below has some other considerations for setting up rules, depending on the situation.

Occasionally some trades occur outside the main trading session boundaries, here are some modifications of the rules for trading outside the main session. In the Asian session we would keep the original five rules in place for the main session then add one more rule. When trading in the Asian session you would also want to enter trades only at the beginning of a new movement cycle on the H1, H4, or D1 time frames. By adding one more rule we can now look to enter trades in the Asian session. Trade at the beginning of the trend cycle on the higher time frames when entering trades in the Asian session.

Many entries in the Asian session are around AUD, NZD, and JPY news drivers, so keep an eye on the forex news calendar for volatile news drivers for these three currencies. Now that you have a rules based forex trading system for trading in the main session, and also the Asian session, you have about 95% of potential trade entries covered.

Only trade a pair when it is starting a new movement after a consolidation or retracement period, or when a non-trending pair starts a new movement or trend (breakout). When you are trading with a trend based system, you would prefer to trade near the beginning of a new movement cycle, so you can sit back and ride the trend for a few days or longer and let the market do the work.

Also, news drivers can move markets and cause stop outs, or additional profits. So you need a set of rules for trading around volatile news drivers.

When entering a trade make sure strong news drivers are at least one hour away to give you time to move your stop to break even on any recently entered trades. Otherwise exit the trade or wait until after the news to consider a new trade entry. Make sure stops are at break-even ahead of any volatile news events on the forex news calendar. Example: If you enter a trade on the USD/JPY and there is a USD or JPY news driver in the next hour, make sure your stop is at breakeven or better before the news.

Understanding the condition of the market is important to forex traders and can be incorporated into a rules-based forex trading system. If many of the pairs and currency groups look choppy on the charts you can set up rules to deal with this problem, like specifying the number of lots traded to be less or staying out of the market altogether. Market conditions change from trending to ranging or choppy and if you can identify this, you can account for this with a new rule.

Drilling down the charts daily with multiple time frame analysis will always give you a clear view of the current market conditions, trending, ranging, oscillating, choppy, on any pair or group of pairs with one common currency.

If you identify a choppy group of pairs or choppy market in general, be prepared to trade less lots on each live trade or not to trade at all until it clears up, which may only take 1 or 2 days. Or else move to another pair. We have an article completely dedicated to trading in a choppy market that would be a great read for these market conditions.

If a forex trader has 6 months to one year of trading experience and is consistently making positive pips, it is possible to “loosen” some of the forex trading rules and look for more trading opportunities. Anyone who has successful traded the forex market this long has earned the right to look for more pips. Experienced traders can look to do short term intra-day trades, trade outside the boundaries of the main trading session, and possibly even do short term trades against the trend. You still need to have a basic set of rules for day trading similar to the ones we have discussed.

If a currency pairs trends in one direction for a long period of time, but cycles in the other direction it is okay to do a short-term trade against the major trend. Short term reversals can and do happen and can continue for a few days.

If the entire market is ranging and you would like to do some short-term trading trying to make 40-50 pips at a time this is not a problem. Just follow the five basic rules we set out in this article. Forex day trading rules are most definitely for experienced traders.

Reducing the time frame for entry below the H4 threshold, down to the H1 time frame, is possible for experienced traders if the other rules are met or there is a fresh movement cycle starting on the H1 time frame.

Experienced forex traders can develop more intricate rules for profit taking, setting price targets, and scaling out additional lots. Advanced forex traders should review our resources related to forex profit management then prepare additional rules based on the ideas presented in this article.

Conclusions About Rules Based Forex Trading – Any forex trader can take this article and use the five basic forex trading rules for trade entries and three basic rules for money management. If you apply the five basic rules your trades will begin to improve, then after 6 months experience you can start experimenting with more rules to incorporate. After gaining experience, you may occasionally loosen the rules depending on what situation the market presents to you and as you become better at identifying different chart situations or market conditions for 28 pairs.