Forex traders can obtain live trading capital and funded trading accounts from third party providers. Hundreds of thousands of traders are receiving funding for their trading account every year from the various capital providers. Any forex trader who has a great trading system and is competent, skilled and profitable, but lacks the funds to trade live should investigate these funding companies.

This article will provide lots of details on what programs are available to get forex account funding. We will also present a low drawdown, profitable trading system to use with the capital and funding providers. Traders can earn strong commissions, like 80% or more, to be paid for their trading skills using these funded accounts.

Companies That Provide Live Trading Capital

Many companies provide live trading capital for forex traders. Here is a partial list: Alpha Capital Group, Audacity, Blue Guardian Capital, Blufx, Enfoid, E8funding, FTMO, Fundednext, Fidelcrest, FTUK, Kickstarttrading, Lux Trading Firm, MyFundedFX, Skilledmarkets, Thefundedtraderprogram, Trueforexfunds, Surgetrader, the5ers, Theproptrading, and Toptiertrader. We also found a handful of forex brokers who have capital referral programs. We present this list as our “partially vetted” list of capital providers. The industry is dynamic but some companies have been around more than 5 years. The industry is dynamic and there might be as many as 50 firms by 2024, it is hard to keep track.

There are also private entities and individuals on places like Linkedin that advertise funding available for forex traders. Some of these capital providers have been in business for several years. You can supplement this list with some Google searches for “forex funding” or “funded forex account”, or “forex prop trading”.

How Much Money Is Available For My Funded Forex Account

Traders who qualify are eligible to receive up to $10,000,000 or more USD in buying power, including leverage, from many of the available capital provider programs. Example, a funding company might offer a trader a $5,000 account with 100:1 leverage, which is $500,000 USD in buying power. Some companies will fund traders in Euros or some other currency other than US Dollars. Be sure to ask what leverage is being used from the providers.

If you start with a small amount of capital, you can easily qualify for much more funding quickly just by increasing your account balance by a small amount, like 10%. Each forex funding provider has their own guidelines for starting balances, leverage and qualifying for more money.

Tip >> if you want more funding for your forex trading account, then open two accounts with two different capital providers. Some traders claim to have 5-6 accounts open at once. So the capital is essentially, unlimited.

Fees For Obtaining Forex Funding

If you are seeking funding for your forex trading account, check the fee structure. Some forex funding and capital providers do not charge any fee at all, but the profit split percentages for the trader are much lower like 50/50. Some funding providers charge one time up front fees or monthly fees. In some cases the fees are 100% refundable out of the trading profits. This is a wide range of possibilities. We consider most of the fees to be reasonable, since the funding providers are covering any trading losses for the end user.

When evaluating a forex funding provider, we would question each provider if the trading platform they provide has institutional spreads or direct access spreads. Inquire if the brokerage platform they provide is also a profit center for their introducing broker operation. Most funding providers likely also make money off of each trade as an introducing broker. Don’t pay for high spreads on top of the fees they charge. Also ask if the underlying broker guarantees the stops or get their stop order policies in writing, some of the capital providers can be very vague with this request.

How Do I Get A Funded Forex Trading Account

Each capital and funding provider has a qualification program to obtain funding. The rules vary quite a bit and some funding companies have “instant funding” programs. Each qualification program has a demonstration or qualification period to obtain the funding. It can be a one or two step process. During the qualification period you must abide by the capital provider’s rules like profit targets, position size, daily and weekly total loss or drawdown limits, maximum number of positions open and position size, etc. Each capital and funding provider has their rules and guidelines are they in writing, so read them carefully. If you break the rules you might be liable for paying more fees to restart the process to get more funding. The demonstration period can vary from one month to several months to hit the profit targets. All of the providers we found cover all trading losses up to the specified loss limits. Don’t be intimidated by the funding qualification process, under some programs you can qualify for funding in as little as one day with just 2 or 3 positive trades. Some funding programs pay you a small amount like15% of profit, during the qualification process.

Important Tip >> You can access much more capital quickly. Some capital providers will increase the amount of capital they make available to a trader for trading profitably. Some capital providers will double the amount of capital you can access for increasing your account balance by only 10%, which is a modest amount of profit. For example, if you get a $5,000 funded trading account (100:1 leverage $500,000) and you increase the account to $5,500 with positive trades, capital providers will double the capital to $1,000,000 from $500,000.

We view this as quite generous, since this can be done with just one swing trade on the H4 time frame or larger time frame. One of the latest trends that the capital providers are using is “instant funding” with almost no qualifying, however the profit split is usually lower like 50/50 or 60/40.

More Criteria For Selecting A Live Trading Capital And Funding Provider

Here are some more criteria for helping to select the best funded forex trading program. Profit splits range from 50/50 to 80/20, with the traders keeping 80%. 50% seems pretty low for a profit split, in our opinion. Profits can be withdrawn via bank wire and in some cases, Paypal, Deel, etc. Transfer fees may apply to small withdrawals. Withdrawals are usually available at the end of the month or bi-weekly. Some have immediate/instant withdrawal.

All of the forex capital providers have drawdown limits. The drawdown is usually measured as the amount of loss of capital from the previous and most recent high balance. Drawdown limits can be weekly or monthly, and range from between 5% and 10% of the high balance, which is a very wide variation. Continue reading this article and we can show you a trading system that can be used that has very little drawdown on each trade entry.

When selecting a live trading capital provider make sure they show you a list of the available pairs that you can trade with their brokerage platform. We recommend checking their offerings against the 28 most actively traded pairs, which are combinations of the 8 most frequently traded currencies. The USD, CAD, EUR, CHF, GBP, JPY, AUD and NZD are the 8 most frequently traded currencies.

Some capital providers only allow trading on 22 or 24 of these pairs, some providers allow the full 28 pairs. Some providers offer a choice of a lot of pairs to trade, but these pairs are outside the 8 most frequently traded currencies. These spreads on these pairs are very high and should not be traded inside of these programs.

Traders should inquire as to what trading platform is offered by the capital provider that you are evaluating. If all of your trading experience is on Metatrader 4, but the capital provider may not offer that platform. If you are seeking their capital might have to download the platform they offer for executing trades and managing the account, so make sure you ask this important question. Being experienced using a new platform is very important before applying for funding. Any new platform should be demo traded so you are familiar with the features and functionality. In 2024 many capital providers have migrated away from MT4.

Some capital providers offer expensive training programs, costing thousands of dollars up front, before you can qualify for capital. We would avoid these capital providers all together. Forexearlywarning can provide a complete training program, our 35 illustrated forex lessons, to teach you everything you need to know about our complete, profitable trading system.

Most of the forex capital providers we reviewed were offering 100:1 leverage. If you are used to trading at 50:1 or some other leverage rate, remember to keep this in mind as it will affect your margin balances on each trade.

We advide selecting a capital and funding provider with no time limit on the number of trades placed and payout denial statistics. If you make a large profit sometimes illegitimate firms will not pay out the profit share amount and they hide behind vague language terms and conditions clauses. There are now “prop firm” evaluation companies that track payouts and payout denials. They have excellent websites that track the good and the bad.Some capital providers do not let you hold trades over the weekend, or even overnight. As long as their stops are guaranteed, the capital providers need to fix this. It makes it impossible to use a forex trading style like swing trading on the H4 time frame, which is where the pips are at. This restriction also prevents any trend-based trading on the higher time frames. Avoid forex funding providers with these types of restrictions that basically force you to day trade. Some capital providers offer a free trial, which is excellent.

Live Trading Capital: Funded Forex Account, Forex Funding

Finding Out More Information and Ratings For Funding Providers

Many funding providers have a social media presence where you can fairly easily monitor the “chatter” from clients using their funding services. We counted 9 different funding providers with over 1000 facebook followers and 15 different funding providers with twitter feeds. We see some value in reviewing these social media feeds as part of the vetting process.

Many of the funding providers have ratings on websites like Trustpilot. Other websites like Propfirmmatch.com are completely dedicated to reviewing funding companies, great resource !

Ask Lots Of Questions !

Use the information below to ask questions of any funding provider.

Basic Questions: What are your fees? Monthly fees, one-time fee, refundable fees? Maximum daily drawdown, maximum total drawdown, payout %, MT4 platform, leverage, profit % target, time period to get profit target. What is your stop order policy, do you guarantee stop executions (get written policy). Other Questions: How long have you been in business or when did you commence business operations? How many traders have you funded? Do you post quarterly or annual statistics about how much you pay out annually or quarterly? If so, please forward most recent statement. Can you send me links to your Facebook and Twitter pages, are you on Trustpilot? Do your traders trade out of a demo account or actual live funded accounts? There are a lot of funding companies in the space, what makes you unique? What leverage do you offer? Do you have the Metatrader (MT4) platform and charting system available? Be careful with companies that want payment via cryptocurrency and have no Trustpilot or social media pages, possible scam?

What is the End Game?

Why would someone obtain trading capital from a third party? Where do you want to be at the end of the journey? Our take: Your goal should be to trade successfully and split the profit with the funding provider. Take some withdrawals and build your own fund to open your own self-funded forex brokerage account for self-trading. Then close the funding account. You can always open another one later. An exception would be if you are getting a 90/10 split and have access to millions of dollars in capital and are happy with everything. You would only stay with a capital provider for the long term if the terms and conditions were exceptional. Otherwise open your own trading account and fund it yourself with capital provider withdrawals. Before starting the process make sure you understand your goals.

Trader Profile For Live Trading Capital And Forex Funding

If you are a forex trader, and would like to have access to third party live trading capital, here are some characteristics we think you should have: Ideally, you should have a trading system that you like a lot, and is effective at making pips. Second of all you should have already set up a demo account and be demo trading the system you like, with at least some level success. With those two criteria in place you should start reviewing the funded forex account providers and look for a provider that fits your needs. If you are a rookie forex trader with little experience, you should avoid all live trading capital provider programs, you are not ready yet.

As far as trading systems we believe you should have a rules based trading system, like the Forexearlywarning trading system. If you can consistently make positive pips when you use it, week after week, you should be ready to apply for funding.

Regardless of the trading system you select, you must like your trading system and understand it well via demo trading or possibly micro lot trading. You must be skilled at entering trades and managing trades with stops and scaling out lots. Forexearlywarning offer thorough market analysis, more exact trade entry points across 28 pairs, and very little drawdown on trade entries. The low drawdown will comply with most capital and funding programs.

Trading System To Use With Your Funded Forex Trading Account

If you are a trader who is seeking capital, and you need a profitable trading system with a low drawdown, we invite traders to check out the Forexearlywarning trading system. You can demo trade our trading system and get consistent trades prior to applying for forex funding.

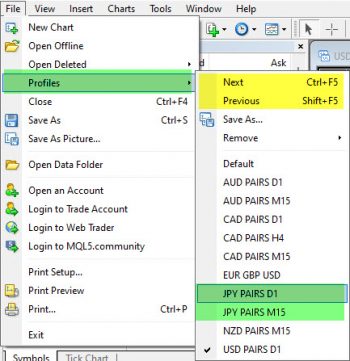

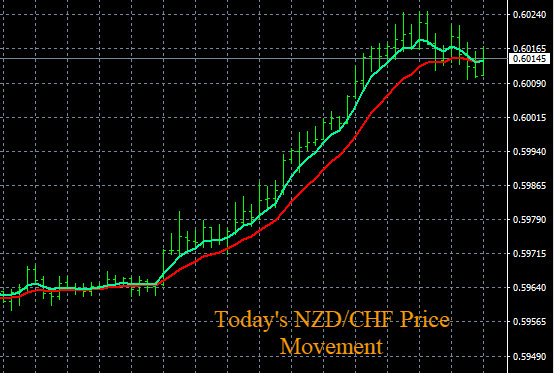

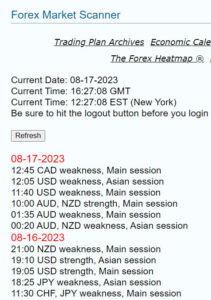

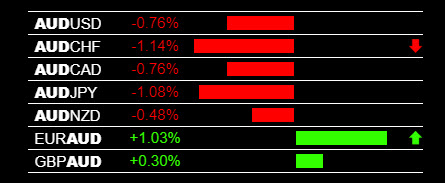

Forexearlywarning provides daily trading plans for 28 pairs, and we focus on the higher time frames and trends, H4 and larger. The higher time frames will get you more pips and profits than scalping the same pairs over and over with technical indicators. Forexearlywarning also has professional alert systems and an excellent trade entry management system, The Forex Heatmap ® forex heatmap. The heatmap will assist with low drawdown trade entry points that satisfy most of the capital providers rules and guidelines.

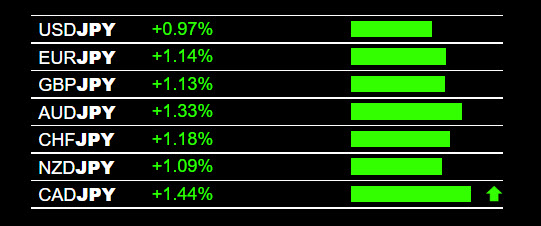

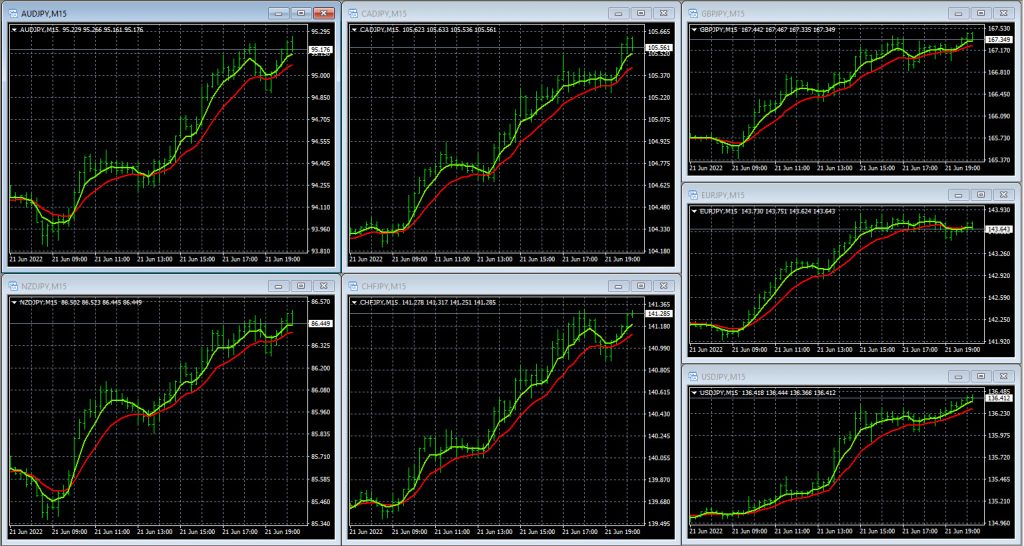

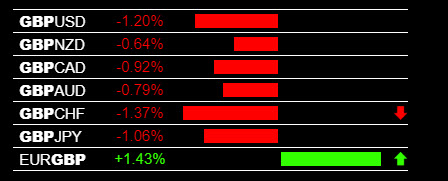

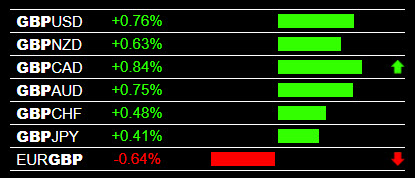

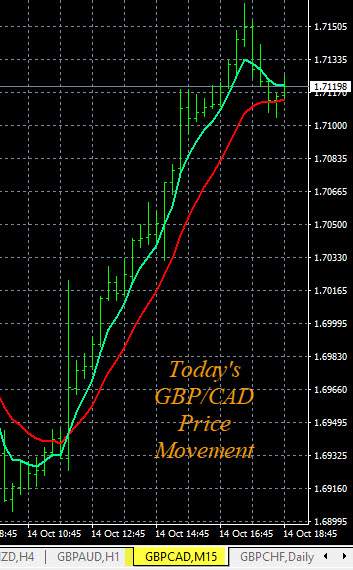

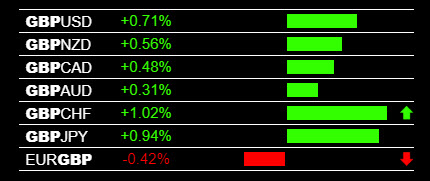

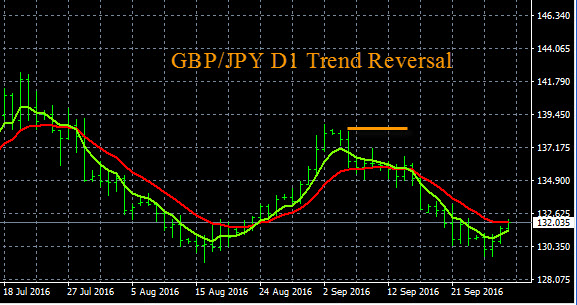

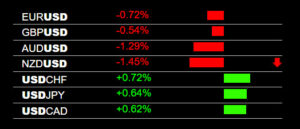

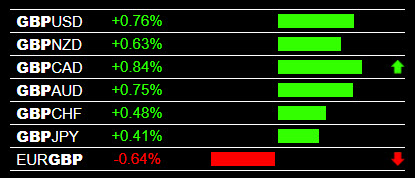

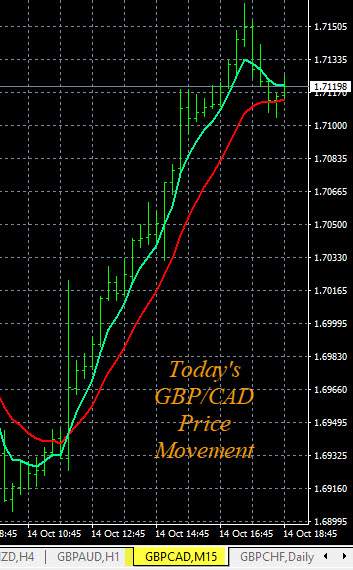

An example trade signal for the GBP pairs on the heatmap is shown below, consistent, clear signals like this for trading are powerful and traders will have very little drawdown on trade entries, as to fully comply with the drawdown rules from most capital providers. Also, the GBP pairs are volatile and the total movement cycle was about 125 pips on the trade below. Strong results for any forex trader. This system works for the GBP pairs and a total of 28 pairs.

Live Trading Capital, Funded Forex Account

Funded Forex Account, Forex Funding

By offering 28 pairs, the Forexearlywarning trading system matches or exceeds the most actively traded and most liquid pairs in most capital provider programs. The heatmap system will provide traders with much lower drawdown on trade entry points so almost any capital program can be used. With the Forexearlywarning trading system, you can easily make 10% on your account balance on one swing trade based on the H4 time frame. This will qualify you for more capital on some of the funded forex account.

Other advantages of using the Forexearlywarning trading system are that is can be easily demo traded. You must understand and like your trading system and enjoy using it before you apply for any third party funded account.

Conclusions about live trading capital programs: A large amount of capital is available to forex traders to fund their live accounts, and we predict that even more capital providers will be available going forward. The industry is growing. Any program that offers a fully funded forex trading account, that also covers your trading losses sound like a great offer.

Traders who have no capital or just a small amount of capital, who are skilled at making positive trades, should evaluate these funded forex account providers. Traders should remember that the trading rules vary between providers, so read each capital providers’ rules carefully, get everything in writing, like the fee structure and drawdown limits.

Finally, make sure you have a trading system that you believe in that is effective at making pips. We have a logical trading system at Forexearlywarning. With a trading system like Forexearlywarning plus third party funding, a forex trading business is possible for very little cost to the end user/trader.