Today in forex news the Chinese Yuan devaluation created strong movement and trading opportunities for forex traders. The Chinese Yuan (CNY) was allowed to appreciate 2% against the US Dollar (USD). The People’s Bank of China made this move due to the recent economic slowdown there, but was still very sudden and unexpected. This was the biggest one day drop in the value of the Yuan in 20 years. Chinese Yuan devaluation against the US Dollar by 2% is hoped to boost the Chinese economy.

This devaluation caused a strong reaction in the forex market. Currencies in the Asian region and currencies of Chinese trading partners were affected by the devaluation. The Japanese Yen (JPY), the Australian Dollar (AUD), and the New Zealand Dollar (NZD) were all affected by today’s devaluation. Most of the price movement and opportunities for forex traders today resulting from the Chinese Yuan devaluation were on these three currencies.

Chinese Yuan Devaluation, Impact On Traders

The AUD and NZD both tumbled on the Chinese Yuan devaluation news, but the Euro (EUR) also strengthened. This produced strong movements in the EUR/AUD and EUR/NZD pairs. The EUR/CAD also moved up strong as all commodity based currencies reacted to the devaluation news.

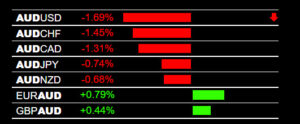

The impact of the devaluation news can produce intraday or trend based trading profits for forex traders. As you can see below, the trading opportunities on the AUD pairs alone was significant. The live indicators shown below, The Forex Heatmap® indicated buy signals on the EUR/AUD, EUR/NZD and EUR/CAD for intra-day or potential longer term buys. All three of these pairs are currently in up trends. This is a valuable lesson on how scheduled or unscheduled forex news or global events can bring profits to any trader. Using this type of real time signal system is highly beneficial.

The movements shown are significant intraday price movements. A 1.69 percent movement in the AUD/USD is about 120 pips, and a 0.79% movement in the EUR/AUD is about 135 pips. Since the EUR/AUD is trending up on the higher time frames, traders can use the Chinese Yuan Devaluation news as and entry point into the trend. Traders can also move their stops to break even, thus preserving their upside potential for even more pips. All traders should consider using The Forex Heatmap® in their trading tool set, along with some simple forex trend indicators.

Currency Devaluations and Interventions

It is important to remember that government interventions and devaluations have been tried many times in the past with various currencies. These devaluations and short term price fluctuations are artificial, and usually short term, due to the high liquidity of currency markets. The overall market forces like the larger time frame trends and interest rate direction will always be the strongest guide for the direction of currencies like the Chinese Yuan, plus the 8 currencies we follow with our trading system.